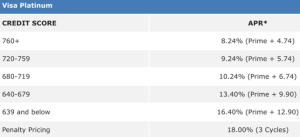

Your Credit Score Affects Your Interest Rate

Put simply, the “credit score scale” is the range of a credit scoring model. I say a credit scoring model because there’s more than one type of credit score out there.

Sure, Fico dominates the credit score landscape, but other competitors are starting to gain traction as well.

[See: Are Fico scores and credit scores the same for more on that.]

As you can see from the illustration above, which is from a credit union’s website, the interest rate you ultimately receive on your credit card is dictated by your credit score.

The higher the credit score, the lower the interest rate, as depicted. This is one reason why you want to aim for the highest score possible. Another reason is simply to get approved for said credit card!

You vs. the Rest of the World

In order to know where you stand credit score-wise, you’ve got to compare yourself to the rest of the public. Without a scale, it’s impossible to rate borrowers on their creditworthiness.

Just like when you were in school, without other students to compare yourself to, you wouldn’t really know where you stand.

We could assume that Consumer “A” is a pretty good borrower, but compared to Consumer “B,” they might be bad news. As a result, their interest rate might be higher, or they might be denied a loan because they’re deemed too risky.

Of course, a good credit score goes beyond that simple three-digit number, but that’s a topic for another day.

Because there are multiple credit scores out there, there are also several credit score scales you must be aware of to accurately gauge your creditworthiness.

The most popular credit score out there by far is the Fico score. It’s used by about 80% of banks, lenders, and other creditors, so it’s the one you should focus on most if you’re concerned about your credit.

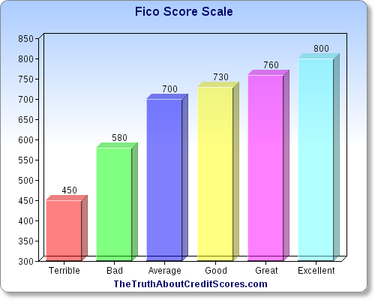

Fico Credit Score Scale

While some of their credit scoring algorithm is a mystery to the general public, we know that the standard Fico credit score scale ranges from 300-850, with scores on the lower end considered “bad” and scores on the upper end considered “excellent.”

In short, a borrower with a 300 credit score would be deemed an extremely high credit risk, and probably wouldn’t get approved for anything, not even a credit card designed for poor credit borrowers.

Conversely, a borrower with an 850 score would have what Fico considers “perfect credit,” and would likely be approved for any loan or credit card they applied for, assuming they met other eligibility requirements such as income and employment.

Check out the illustration of the “Fico score scale” I made above, which shows a range of credit scores from terrible to excellent. This should give you an idea as to where you stand, assuming you already know your credit scores.

As you can see from this image, the median Fico score is around 700, so you’ll want to be above that number to ensure you qualify for the credit cards and loans you apply for, including money-saving balance transfer offers.

There are even incentives for credit scores above 740, so shoot for the stars here folks if you want to save the most money!

[Average credit score by age.]

It’s also important to note that there are several different versions of the Fico score used by specialized industries, such as auto lenders, that use different completely different scales, with credit scores as low as 250 and as high as 900.

So be sure you know the proper scale being used to accurately determine your creditworthiness. It should be listed somewhere next to your credit score(s) on your credit report or on the disclosure mailed to you if you apply for credit.

VantageScore Credit Scale

Another popular consumer credit score is the VantageScore, which is the second most relied upon credit score out there, but comes nowhere close to Fico in terms of market share. But that could change, so you should know where you stand here as well.

The VantageScore credit score scale ranges from 501-990, with higher credit scores again deemed more favorable. A 501 is the worst credit score you could possibly achieve, while a 990 would signify perfect credit.

VantageScore also used handy letter credit grades that separate borrowers in buckets, including A, B, C, D or F. And just like in college, an A is the most desired grade, while an F is obviously frowned up.

A “C” letter grade would put you near the median VantageScore, but you’d likely want to be in the “B” bucket to get the most favorable rates and highest chance of approval.

I don’t think there are multiple version of VantageScore at the moment, so you should only have to worry about the one scale. That might change as time goes on so keep an eye out for other scales.

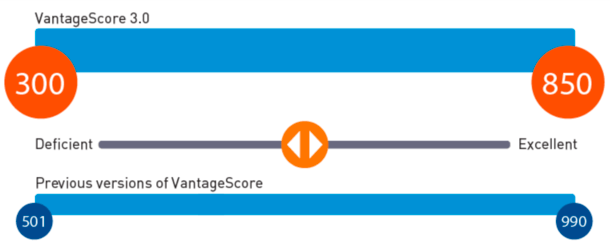

VantageScore 3.0 Now Uses the Fico Score Range

A small, but important update. The VantageScore credit scale is now the same as the standard Fico scale of 300-850. They changed it to simplify things when they rolled out VantageScore 3.0.

I believe Fico tried to patent their scale but failed in court, ushering in competitors that use the exact same numbers.

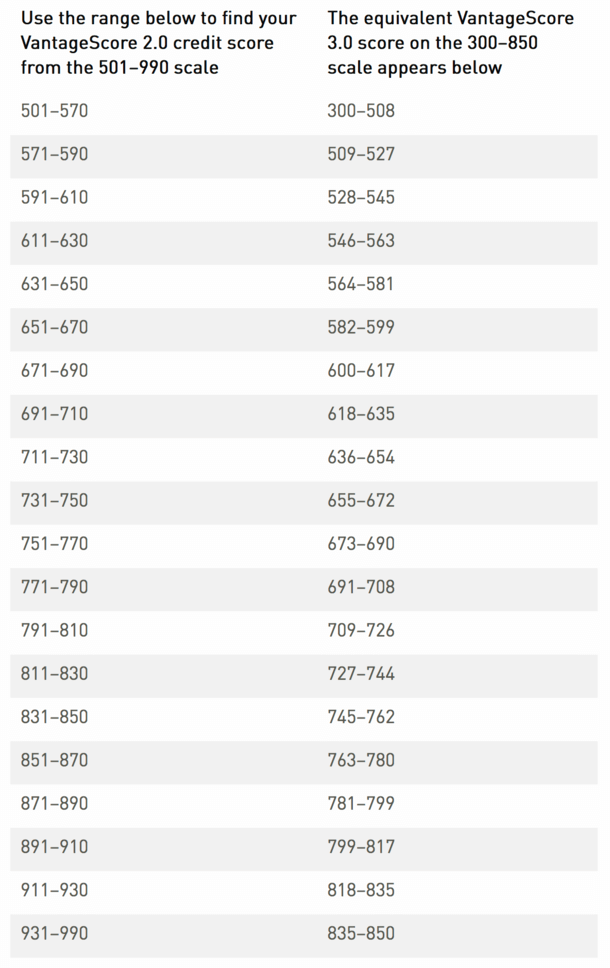

So be sure you know which VantageScore the lender is using to accurately assess your credit. For reference, the guide below will show you where you stand on the new scale if you have an older version of the score.

It’s a cool, quick way to generate your new score using your old score.

In summary:

Fico Credit Score Scale: 300-850 (industry versions with different scales are also used)

VantageScore Scale: 501-990

VantageScore 3.0 Scale: 300-850

The higher you score the better…aim for a Fico score above 800 and a VantageScore above 900 to ensure you get approved for all the loans and credit cards you apply for at the very best terms.

Read more: Can you raise your credit score fast?

I dig the VantageScore comparison chart. The old 700 score was practically subprime.